Companies that attract and retain talent have an easier time achieving long-term growth. The key to balancing retention while managing compensation expenses is understanding the competitive market for a specific position. Utilizing a salary survey is typically the starting point for benchmarking compensation, and while compensation surveys are the foundation for creating informed strategies, how the benchmarking exercise is executed is vitally important. In this article, we’ll evaluate how differences in various salary survey sources may impact the benchmarking output. We will use human resources positions to explore why utilizing several data sources is imperative when conducting a market study.

What Is Compensation Benchmarking?

To succeed, companies must be able to fill essential roles with capable employees and retain them. If an organization playing a game of tug-of-war for talent suddenly loses its anchor or struggles to fill competency gaps, it may lose its competitive edge. Compensation benchmarking, or market pricing, involves analyzing and comparing your company’s salary structures against industry standards and competitors using salary surveys and other data sources.

By understanding where your organization stands in relation to others, you can identify areas for improvement in your pay structure to create competitive compensation packages that help retain talent and recruit high-caliber candidates.

Why Utilizing Several Survey Data Sources Is Imperative in Compensation Benchmarking

While it may seem efficient to streamline survey data collection through one channel, this could lead to a narrow perspective that overlooks vital nuances in the market. A singular data source may not capture the full spectrum of industry standards, regional variations, or emerging trends. This lack of comprehensive insight can result in compensation packages that fail to attract and retain top talent, ultimately hindering your organization's growth. Additionally, decisions based solely on one dataset may inadvertently perpetuate biases or inaccuracies that could alienate key employees.

By integrating multiple survey data sources, organizations can capture a more comprehensive view of their industry landscape. This not only enhances the reliability of the benchmarks but also allows leaders to identify trends and patterns that may otherwise go unnoticed. For instance, combining quantitative surveys with qualitative feedback provides a richer narrative that helps in understanding the nuances behind the numbers.

Test Case Methodology

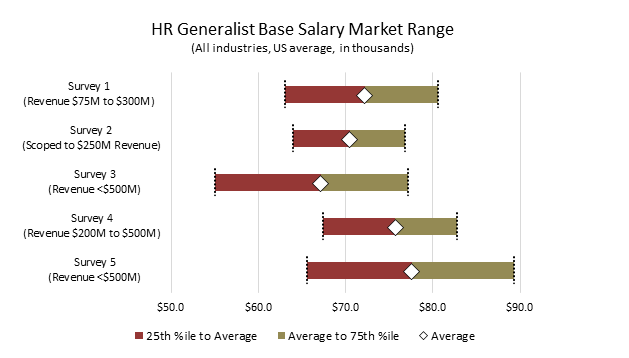

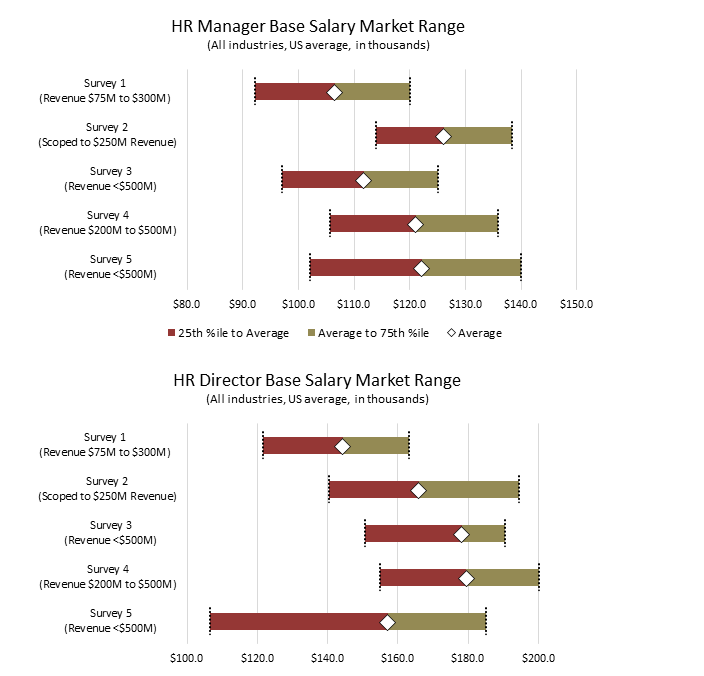

We pulled survey data from five salary surveys for three standard human resources positions: generalist, manager, and director. The surveys were scoped to encompass all industries with $250M in revenue and utilized the U.S. average geographic differential.

The following three charts show the market range (25th percentile, average, and 75th percentile) for each position across each survey source.

Take Charge of Your Compensation Strategy With Effective Benchmarking Practices

As illustrated above, one survey can tell a completely different story than another, even if it is scoped to the same industry, size, location, and has a robust number of participants. Companies looking to conduct compensation benchmarking studies can use the following questions to help understand the process:

- Which positions will be benchmarked?

- Which data sources and surveys will be used, and does your organization currently participate in surveys?

- How will the data sources be refined by industry, company size, and location?

- Are there certain positions that your organization is having difficulty retaining?

- Which competencies and skills are most important to your company’s long-term strategy?

It may not be cost-effective for a company to purchase several surveys for its market pricing initiatives. Having a resource with access to multiple data sources, including real-time data, can significantly impact the results of a market study.